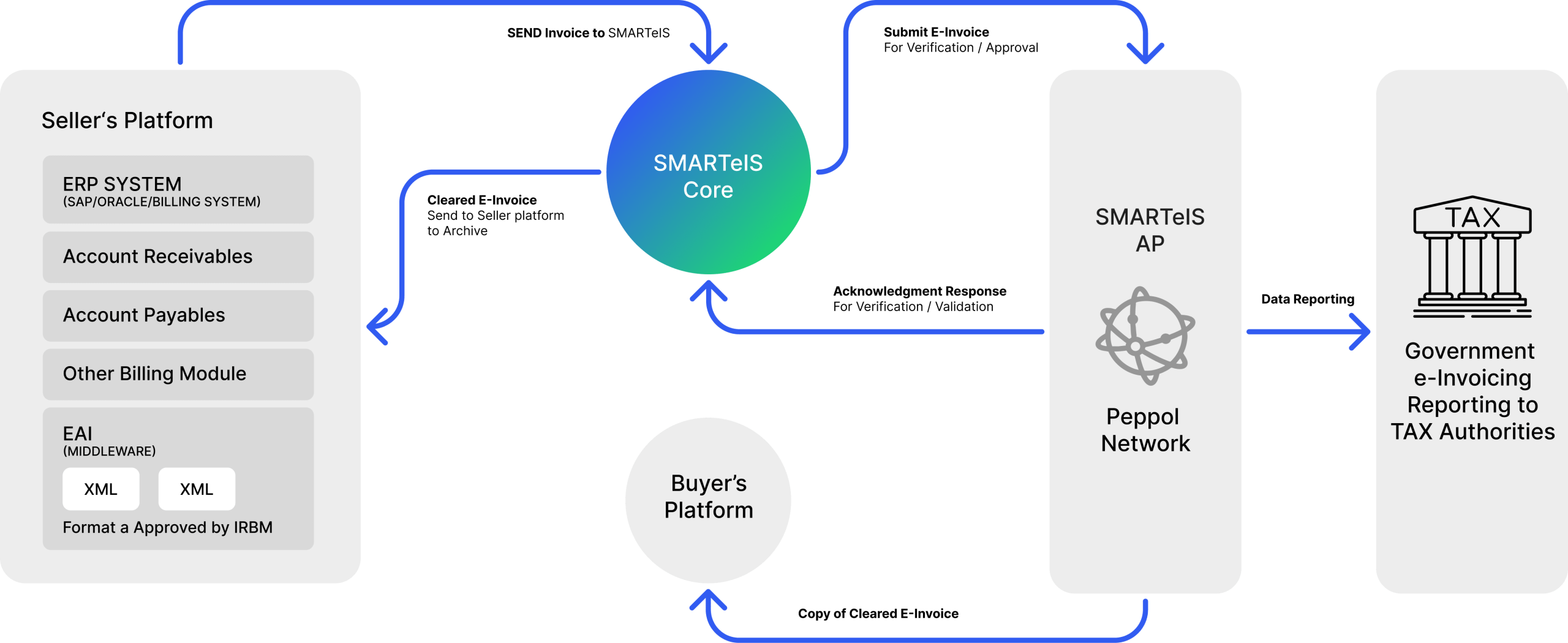

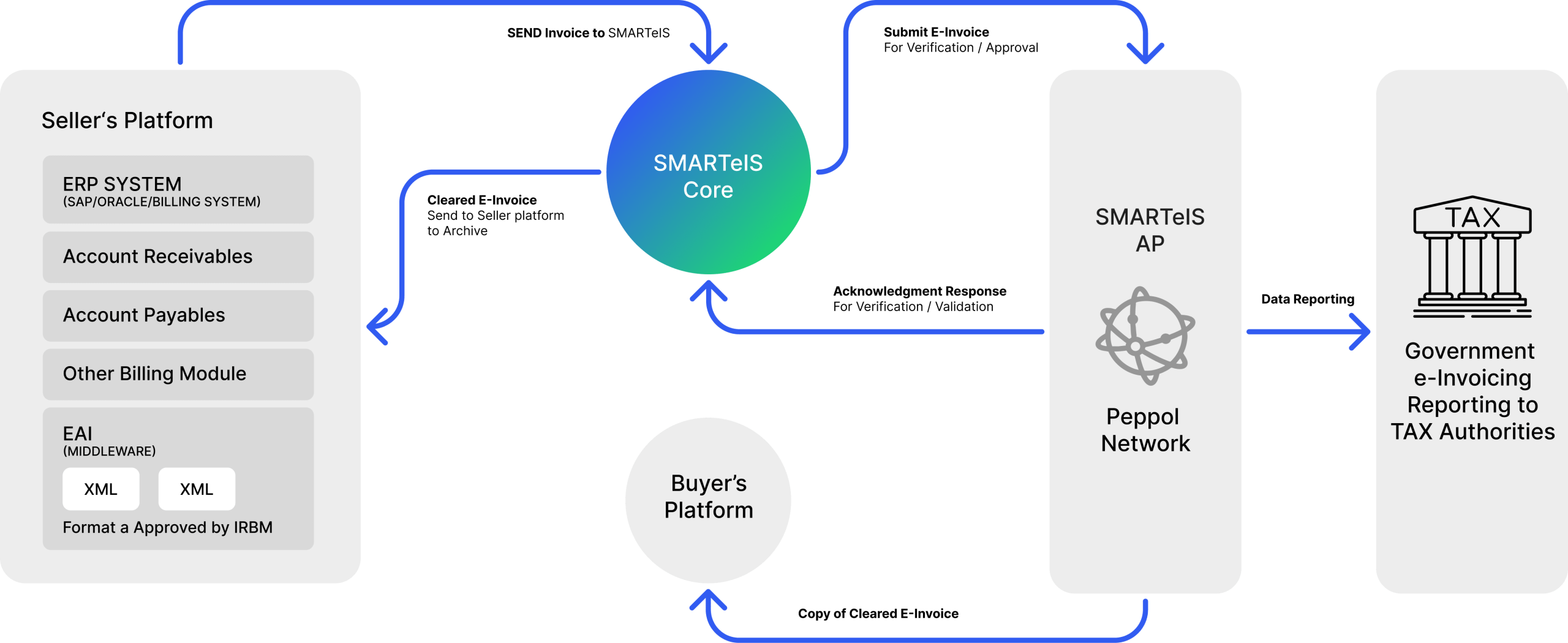

Whether ensuring compliance across Europe through Peppol-based e-invoicing, integrating seamlessly with ERP systems for smooth invoicing across Asia, or aligning with evolving tax regulations in the Middle East, SMARTeIS adapts to regional e-invoicing requirements through a single, scalable platform.

Already a trusted e-invoicing solution provider for enterprises in Singapore and Malaysia, SMARTeIS is rapidly expanding its footprint in the UAE as a pre-approved e-invoicing solution, offering a Peppol-aligned platform designed to support Federal Tax Authority (FTA) requirements under the UAE e-invoicing framework.

As an FTA-aligned and pre-approved e-invoicing platform, SMARTeIS enables UAE businesses to implement a compliant, future-ready e-invoice system while maintaining interoperability with global trading partners. This makes SMARTeIS suitable for enterprises, SMEs, and government-linked entities operating in or from the UAE.

Available as SaaS and PaaS, SMARTeIS supports rapid deployment, elastic scalability, and enterprise-grade support—helping organizations modernize invoicing operations while staying compliant across India, Malaysia, Singapore, Belgium, and the UAE.

By centralizing compliance logic within its middleware, SMARTeIS allows organizations to future-proof their invoicing landscape without frequent ERP changes, supporting cross-border growth in an increasingly regulated digital economy.

SMARTeIS offers flexible deployment

options—On-Premise for full data control or Cloud-Hosted SaaS for scalability, speed, and seamless integration with your existing infrastructure.

Operate seamlessly across global frameworks with our electronic invoicing software—connect through the PEPPOL e-invoicing network while remaining aligned with UAE e-invoicing reporting requirements. SMARTeIS supports Peppol-based e-Invoicing readiness in the UAE, helping regulated businesses prepare for upcoming mandates without vendor lock-in.

Avoid validation failures with our FTA-Compliant e-invoicing solution, featuring pre-configured FTA data fields and validation rules to ensure every invoice generated through the e invoice system is accepted the first time.

Built for UAE’s largest enterprises, our e-invoicing software provider platform is proven to handle immense scale, processing 100,000+ invoices per month, positioning SMARTeIS among the top e-invoicing solutions in UAE.

Gain clear visibility with real-time reconciliation of tax data reported to FTA against ERP records, supported by graphical dashboards and exportable reports—making it one of the best e-invoice software options for enterprise compliance.

Get support from our local team. SMARTeIS is a trusted E-Invoicing Partner, ISO 27001, SOC 2 Type II, and Peppol Certified.

Don’t leave compliance to chance. Join the leading UAE enterprises that

trust SMARTeIS. Schedule a demo to see our FTA validations in action

and receive a free consultation on your e-invoice readiness.

SMARTeIS is a unified global electronic invoicing software with country-specific compliance modules. Connect your ERP once to this e-invoice system, and it automatically applies FTA-compliant e-invoicing rules in UAE, integrates with LHDN Malaysia, and routes invoices via PEPPOL e-invoicing (InvoiceNow) Singapore—making it a scalable e-invoicing solution provider for global enterprises.

PEPPOL e-invoicing delivers a secure, standardized, and interoperable framework that email-based invoicing cannot match. Invoices are exchanged in machine-readable XML directly between certified e-invoicing systems, eliminating manual data entry, reducing errors, and significantly lowering the risk of invoice fraud. This structured exchange accelerates payment cycles, improves reconciliation, and supports B2G e-invoicing mandates, making PEPPOL the preferred global standard for compliant electronic invoicing.

SMARTeIS supports the PINT (Peppol International Invoice) standard to enable secure cross-border PEPPOL e-invoicing. As a unified electronic invoicing software, it automatically formats invoices to international standards while applying country-specific tax rules for the exporting jurisdiction. The SMARTeIS e-invoice system manages multi-currency conversion, cross-border tax code mapping, and structured XML exchange, helping enterprises ensure global compliance, reduce errors, and scale international invoicing operations efficiently.

SMARTeIS follows an ERP-agnostic e-invoicing architecture. A single integration—via API, SFTP, or standard ERP connector—connects your global SAP or Oracle instance to the SMARTeIS platform.

All country-specific e-invoicing compliance, such as India e-Invoicing, Malaysia IRBM, Singapore (Peppol/IMDA), Belgium (Peppol), and UAE (FTA / PINT-AE), is managed within the SMARTeIS middleware, not within the ERP.

This approach keeps the global ERP instance clean, eliminates the need for country-specific plugins, reduces ongoing regulatory maintenance, and enables SMARTeIS to scale as a single e-invoicing solution for multinational compliance

SMARTeIS is built on a regionally distributed electronic invoicing software architecture with configurable data residency policies. Data for European entities is processed and stored within EU-based data centers to meet GDPR compliance. At the same time, countries with strict residency laws, such as Saudi Arabia or China, are handled locally. This secure e-invoice system ensures regulatory compliance, supports global operations, and provides centralized visibility for headquarters through a trusted e-invoicing solution provider.

SMARTeIS provides real-time tax analytics, AI-powered validations, and automated tax reporting, helping businesses meet VAT and regulatory requirements while reducing compliance risks.

SMARTeIS accelerates supplier onboarding through the Peppol Directory, enabling instant connectivity across the global PEPPOL e-invoicing network. By publishing a unique Peppol ID, suppliers in 40+ countries can exchange invoices without custom EDI integrations. The SMARTeIS electronic invoicing software and e-invoice system ensure structured XML exchange, regulatory compliance, and faster adoption. For non-Peppol suppliers, a secure Supplier Portal enables PO-to-invoice conversion, positioning SMARTeIS as a scalable e-invoicing solution provider.

Absolutely. SMARTeIS includes a robust Global Validation Engine built into its electronic invoicing software. Before any invoice is transmitted to government platforms such as LHDN Malaysia or Saudi ZATCA, data passes through the SMARTeIS e-invoice system for mandatory field checks, tax code mapping, mathematical accuracy, and XML schema compliance. Invalid invoices are blocked and returned for correction, ensuring FTA-compliant e-invoicing, reducing audit risks, and positioning SMARTeIS as a trusted e-invoicing solution provider.

Yes. SMARTeIS includes a secure Global Digital Archive within its electronic invoicing software. Businesses can configure country-specific retention policies—such as 7 years for Malaysia or 10 years for Germany—to meet local compliance requirements. All invoices are stored in their original structured e-invoice formats (XML/JSON) along with validation artifacts, digital signatures, and government clearance IDs, ensuring audit-ready e-invoicing, regulatory compliance, and trusted record management through a centralized e-invoice system.

Yes. SMARTeIS is a modular SaaS electronic invoicing software designed to scale globally. As your business expands into new markets—such as Poland’s KSeF or France’s PDP e-invoicing framework—you can instantly activate the required country-specific compliance module within the SMARTeIS e-invoice system. New mandates are continuously added as regulations evolve, ensuring ongoing compliance, reduced implementation effort, and a future-proof e-invoicing solution that adapts seamlessly to global regulatory changes.

A clear, structured path to ensure your success from day one.

Product demo and a customized proposal for your business.

Tenant registration, compliance workshop, and KYC collection.

Sandbox enabling and thorough testing to ensure perfection.

Hypercare period and ongoing maintenance with zero cost for regulatory updates.