E-Invoicing in A Comprehensive Overview | SMARTeIS

Discover SMARTeIS – a next-gen electronic invoicing solution by Skill Quotient Technologies, built on globally trusted Peppol e-invoicing standards.

Whether you’re ensuring full compliance across Europe, integrating with ERP systems for smooth billing in Asia, or meeting evolving tax regulations in the Middle East, SMARTeIS adapts to your regional needs.

Already the preferred e-invoicing platform in Singapore and Malaysia, SMARTeIS is now gaining rapid traction in the UAE with a dedicated Peppol e-Invoicing UAE module designed for compliance and scale.

Available as both PaaS and SaaS, SMARTeIS deploys instantly, scales on demand, and includes 24×7 expert support—so you can invoice smarter, anywhere in the world.

Benefits of E-Invoicing

The adoption of e-Invoicing yields a spectrum of advantages, enhancing the fiscal landscape for both taxpayers and businesses. Key benefits include:

The introduction of e-Invoicing reduces reliance on manual efforts, minimizing the potential for human errors. This is achieved through a unified process that digitally creates and submits transaction documents and data.

The seamless integration of systems under e-Invoicing not only expedites tax reporting but also ensures accuracy in the filing process. This efficiency contributes to a more streamlined and error-free tax compliance.

E-Invoicing goes beyond tax-related benefits, bringing about enhanced operational efficiency. This translates into significant time and cost savings for businesses, allowing resources to be allocated more strategically.

A pivotal aspect of e-Invoicing is the digitalization of financial reporting. This aligns financial processes with industry standards, bringing about a comprehensive transformation in how financial data is managed and reported.

The digital nature of e-Invoicing promotes transparency in financial transactions, fostering trust between business entities. This transparency is crucial for building robust financial relationships and facilitating smoother business operations.

E-Invoicing contributes to environmental sustainability by reducing the reliance on paper. This not only aligns with eco-friendly practices but also leads to cost savings associated with traditional paper-based invoicing.

In essence, the implementation of e-Invoicing transcends mere convenience, ushering in a new era of accuracy, efficiency, and transparency in financial and tax-related processes.

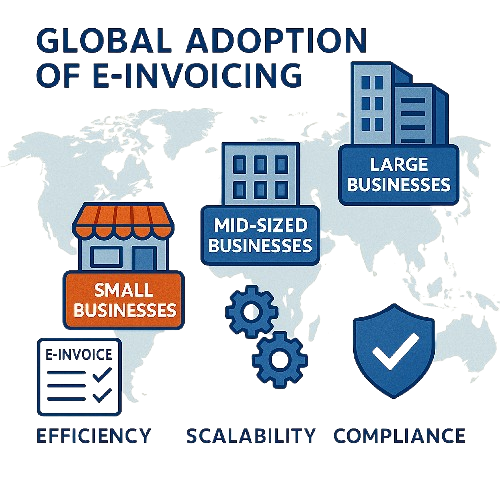

The Global Shift to e-Invoicing:

A Strategic Imperative

The adoption of e-Invoicing is not merely a technological upgrade—it’s a strategic necessity for businesses worldwide. Governments and tax authorities across the globe are implementing e-Invoicing in phases, often based on business size, revenue thresholds, or industry sectors. This phased approach ensures a smooth and manageable transition for organizations, allowing them sufficient time to prepare, integrate, and comply with evolving regulatory standards. Embracing e-Invoicing today positions businesses for enhanced efficiency, compliance, and global scalability.

Empowering Businesses What Skill Quotient Technologies Brings to the Table

Skill Quotient Technologies heralds a new era of business empowerment with the introduction of SMARTeIS (Smart Electronic Invoicing System), an all-encompassing e-Invoicing solution meticulously crafted for the global market.

Developed under the discerning guidance of preeminent financial experts worldwide, SMARTeIS stands as the epitome of innovation. A comprehensive survey of prevailing invoicing systems across various regions served as the foundation, allowing our adept technical team to engineer a solution that not only seamlessly integrates with existing systems but also facilitates a user-friendly adoption process.

Prioritizing adherence to stringent international regulations and tax authority standards, SMARTeIS ensures full compliance while concurrently prioritizing an unparalleled user experience.

The culmination of these efforts positions SMARTeIS as the unrivaled leader in the realm of e-Invoicing, exemplifying Skill Quotient Technologies’ commitment to advancing businesses globally with superior technological solutions.

Trusted Expertise

Why Skill Quotient Technologies is

Your E-Invoicing Partner

Skill Quotient Technologies proudly marks its successful completion of eight years. As a multinational software company, our global headquarters are strategically located in Kuala Lumpur, Malaysia. Our international footprint spans a workforce of over 1000 dedicated professionals. Demonstrating robust and sustained growth, we have consistently maintained an impressive growth rate.

In our pursuit of excellence, we have forged exclusive partnerships with 15 esteemed organizations. Notably, Skill Quotient Technologies holds the prestigious status of being a certified Gold Partner with Microsoft, attesting to our commitment to delivering top-tier technological solutions. Additionally, we have achieved CMMI Level 3 certification, underscoring our dedication to maintaining high-quality software development processes. Moreover, our adherence to information security standards is evident through our ISO/IEC27001:2013 certification.

In furtherance of our commitment to industry-leading standards, Skill Quotient Technologies is honored to hold partnerships with SAP and OpenText, adding to our portfolio of esteemed affiliations.

Skill Quotient Technologies remains unwavering in its commitment to innovation, global collaboration, and the delivery of cutting-edge software solutions.

The Seamless e-Invoicing Solution by Skill Quotient

Technologies | SMARTeIS

Flexibility

SMARTeIS can convert any file format (XML, CSV, XLS, etc) to JSON / XML and upload in IRBM myInvois and process the write back.

Single user interface

User to access only one interface for e-invoice generation.

Data validation

Upfront validation of data from the perspective of IRBM.

Reconciliation

2-way reconciliation between

ERP vis-à-vis IRBM myInvois.

All-in-one solution

SQ E-Invoice supports all myInvois scenarios to include invoices, credit notes, debit notes, refund, cancellations, and notifications.

Frequently Asked Questions

What is e-Invoicing?

E-Invoicing is the process of issuing and receiving invoices in an electronic, structured format instead of paper or PDFs. In the UAE, businesses must use an FTA-Compliant e-Invoicing Solution or an e-invoice system that ensures VAT compliance, accuracy, and security.

Is e-Invoicing mandatory in the UAE?

Yes. The UAE has introduced mandatory phases of e-Invoicing for VAT-registered businesses. Over time, all B2B and B2G invoices must be issued through e-Invoicing software or a certified e-Invoicing Partner.

In what format should invoices be generated?

The best e-Invoicing software in UAE creates invoices in structured XML/UBL formats that meet FTA standards. PDFs or scanned images alone are not accepted as valid invoices.

What is PEPPOL e-Invoicing, and how does it apply in the UAE?

PEPPOL e-Invoicing is a global standard for cross-border electronic invoicing. The UAE is adopting it to ensure seamless B2B and B2G transactions. Businesses must choose a Peppol e-Invoicing UAE solution or connect with an accredited e-Invoicing Partner to comply.

How are e-Invoices generated and exchanged?

Invoices are generated through e-Invoicing software providers or via a Peppol e-Invoicing UAE solution, which assigns digital signatures, validates data, and transmits invoices securely.