What is e-Invoicing

The Malaysian government is set to revolutionize its tax administration management with a phased implementation of e-Invoicing, aimed at fostering the growth of the digital economy. Announced by the Ministry of Finance, this strategic move is poised to elevate service quality, alleviate compliance burdens on taxpayers, and significantly enhance the overall efficiency of business operations. The introduction of e-Invoicing in Malaysia signifies a pivotal step towards streamlining processes, reducing costs, and propelling the nation into a more digitally advanced era.

Mandatory e-Invoicing: Transforming Business Dynamics in Malaysia

In the landscape of e-invoicing in Malaysia, a significant shift is on the horizon. While not obligatory until recently, the option for electronic invoicing has been available since 2015, contingent upon explicit consent or authorization for its reception. The catalyst for this transformation stems from the introduction of the Tax Identification Number (TIN) in 2022, laying the groundwork for a more streamlined and digitized fiscal framework.

As of March 2023, Malaysia has set the wheels in motion for a mandatory e-invoicing paradigm. This strategic decision aims to elevate service standards, alleviate compliance costs for taxpayers, and usher in heightened operational efficiency for businesses. The Inland Revenue Board (IRB) of Malaysia has meticulously outlined a phased plan for e-invoicing implementation, commencing with a pilot program in 2024 for a select group of companies.

This mandatory shift towards electronic invoicing encompasses a broad spectrum, encompassing B2G, B2B, and B2C transactions, spanning both domestic and cross-border interactions. The Malaysian government’s envisioned model rests on the utilization of CTC connected to the Peppol network, ensuring a comprehensive and interconnected invoicing infrastructure.

Following pivotal changes in October 2023, the official commencement of the obligation is slated for August 2024, marking a crucial milestone in Malaysia’s journey toward a more digitally integrated and efficient economic landscape. Stay tuned for the unfolding chapters of e-invoicing evolution in Malaysia, as businesses gear up for a transformative era of fiscal management.

Seamless e-Invoicing Solution by Skill Quotient Technologies

Embark on a transformative journey with our cutting-edge e-invoicing solution, meticulously crafted to cater to Malaysia’s IRBM compliance standards. Elevate your invoicing processes to new heights as we offer a comprehensive approach, streamlining end-to-end reporting within the framework of Malaysia’s e-invoicing regulations.

At the heart of our offering is a deep dive into your unique business processes, ensuring that our solution seamlessly aligns with your specific needs. We understand the intricacies of IRBM compliance, and our tailored solution is designed to not only meet but exceed the expectations of businesses operating in Malaysia.

What sets us apart is the simplicity of integration. With our public API, connecting your systems with ours is a breeze, creating a harmonious ecosystem where your operations seamlessly merge with our advanced e-invoicing infrastructure. Say goodbye to complexities, and join us in pioneering a new era of effortless e-invoicing in Malaysia.

Experience the ease of compliance, the power of integration, and the innovation of a solution designed to elevate your invoicing processes. Join us in shaping the future of e-invoicing in Malaysia — where efficiency meets excellence.

SMARTeIS

The Seamless e-Invoicing Solution by Skill Quotient Technologies

Flexibility

SMARTeIS can convert any file format (XML, CSV, XLS, etc) to JSON / XML and upload in IRBM myInvois and process the write back.

Single user interface

User to access only one interface for e-invoice generation.

Data validation

Upfront validation of data from the perspective of IRBM.

Reconciliation

2-way reconciliation between

ERP vis-à-vis IRBM myInvois.

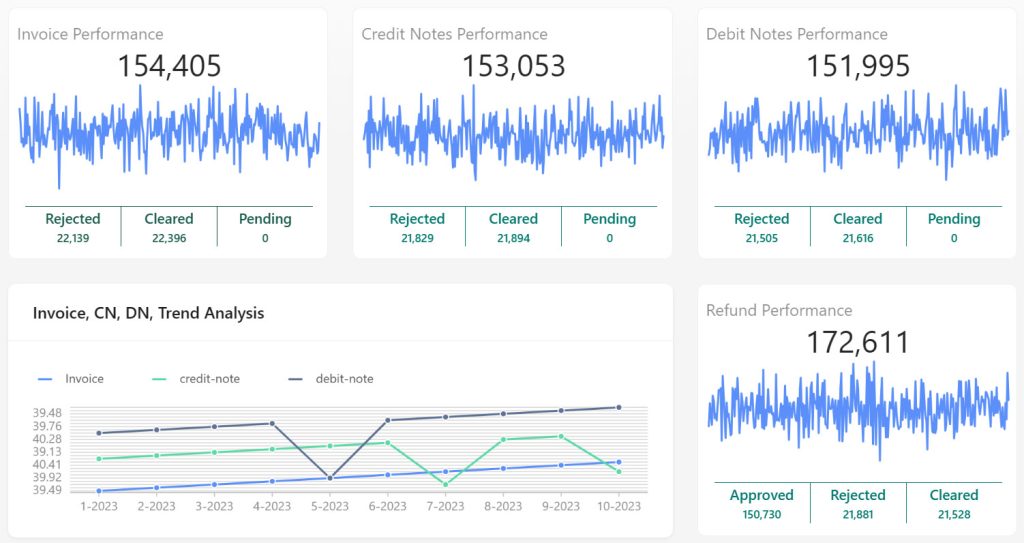

All-in-one solution

SQ E-Invoice supports all myInvois scenarios to include invoices, credit notes, debit notes, refund, cancellations, and notifications.